Retirement plan solutions are evolving, and many small- to mid-size employers are rethinking how they manage their 401(k) benefit. Pooled Employer Plans (PEPs) represent a shift toward smarter, more scalable retirement solutions. In addition to meaningful cost savings, PEPs offer operational efficiency, investment advantages, and reduced risk. This makes them an increasingly attractive option for forward-looking finance and HR leaders. In this article, Meghan Hannon, CRPS®, CPFA®, Partner and Head of Retirement Plan Consulting, discusses the business case behind PEP adoption.

How PEPs Create Cost Efficiency

PEPs allow multiple unrelated employers to participate in a single retirement plan structure. This pooled approach generates efficiencies across investment management, administration, recordkeeping, and compliance. The result is lower total plan costs and a reduced workload for internal teams.

- Economies of Scale: When employers pool their assets, they gain collective purchasing power, which leads to better pricing from recordkeepers, custodians, and investment managers. Small and mid-size companies that might otherwise pay retail pricing can often access lower institutional fees.

- Example: A company with $5 million in assets and 50 participants might pay 0.80% in investment fees under a traditional 401(k). Within a PEP, that could drop to 0.35%, saving over $22,500 per year—money that stays in participants’ accounts rather than being spent on fees.

- Administrative Simplification: Instead of managing multiple vendors and contracts, employers in a PEP benefit from a consolidated structure. That means fewer administrative burdens, easier oversight, and a single point of contact for services.

- Shared Audit and Compliance Costs: Employers with more than 100 account balances are generally required to file a “large plan” audit each year. This can cost between $10,000 and $20,000 annually. PEPs spread these audit costs across all eligible employers, significantly lowering each company’s share. Centralized compliance oversight also reduces the need for outside legal and consulting support for day-to-day plan governance.

- Streamlined Technology: PEPs typically operate on shared technology platforms for plan administration, payroll integration, and participant communication. This helps deliver better used experience at a lower per-participant cost.

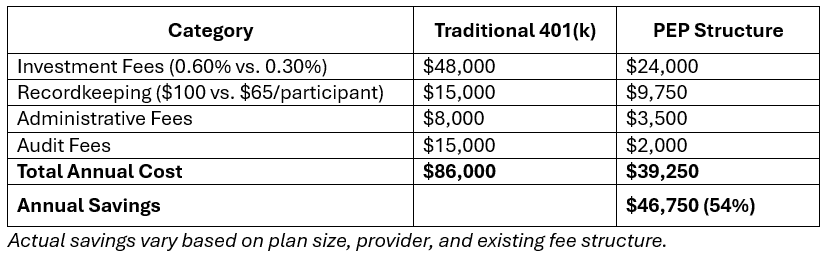

Cost Comparison: Traditional 401(k) vs. PEP

Let’s look at a mid-size professional services firm with 150 employees and $8 million in plan assets:

Beyond Cost: Why Employees Are Really Choosing PEPs

While lower fees are a clear advantage, most employers choose PEPs for the broader operational value:

- Reduced Risk and Fiduciary Burden: PEPs transfer many fiduciary responsibilities, such as plan oversight, investment selection, and compliance monitoring, from the employer to the PEP provider. This helps reduce legal exposure and simplifies governance.

- Better Investment Menus: Employers can access institutional share classes and professionally curated investment lineups that support stronger long-term outcomes.

- Reduced Internal Burden: Administrative tasks like annual filings, compliance testing, and participant communications are handled by the PEP, freeing up internal resources.

- Improved Employee Experience: Centralized service models and modern technology platforms improve communication, enhance the user experience, and help participants better prepare for retirement.

What to Consider Before Joining a PEP

PEP structures vary by provider. Differences in fees, investment quality, flexibility, and service levels can be significant, so it’s important to evaluate options carefully. As you assess whether a PEP fits your organization, consider the following:

- Cost of Ownership: Compare all plan-related fees, including investment management, administration, recordkeeping, and audit expenses.

- Service Quality: Ensure that cost savings don’t come at the expense of participant support, technology, or responsiveness.

- Investment Philosophy: Look for access to low-cost, high-quality investments that align with your workforce’s needs.

- Flexibility: Confirm whether the PEP structure allows for custom plan features like eligibility rules, match formulas, or vesting schedules.

Working with a qualified retirement plan advisor can help you evaluate the differences and select the right PEP for your organization and employees.

Is a PEP Right for Your Business?

Pooled Employer Plans give small and mid-size employers a smart way to cut costs, simplify administration and improve participant outcomes. Most see savings soon after transitioning and realize the full benefit within the first year. A knowledgeable retirement plan advisor can guide a smooth onboarding, compare providers and help design a plan that fits your business and employees. Connect with us to learn more about Pooled Employer Plans and how we’re committed to helping you get there.

Investment Advisory Services offered through Boulay Financial Advisors, LLC a SEC Registered Investment Advisor.