Outsourced bookkeeping can be a game-changer for businesses seeking improved accuracy, cost efficiency and access to specialized accounting expertise. However, merging outsourced accounting with your in-house team requires careful planning and execution to avoid disruptions. In this guide, we outline key steps and considerations to help ensure a smooth integration of outsourced bookkeeping services.

1. Conduct a Needs Assessment

Before making any changes, perform a comprehensive evaluation of your current bookkeeping functions. Determine which tasks you want to outsource, and which will remain in-house, to identify the specific services your business requires. Are you seeking assistance with payroll processing, accounts payable and receivable, financial reporting, or all of the above? Clearly outline your primary objectives—such as cost reduction, improved accuracy or streamlined processes—to guide your decision-making.

2. Select the Right Outsourced Bookkeeping Partner

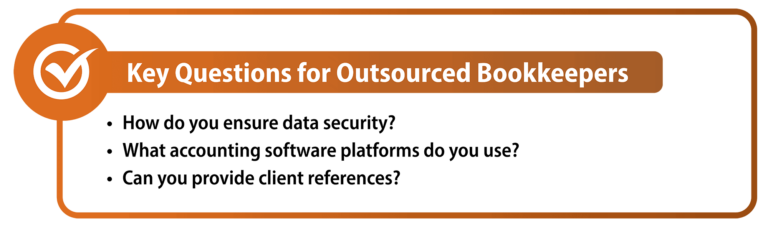

Choosing the right provider is critical. Look for an outsourced bookkeeper with experience in your industry, a strong reputation and a proven track record. Evaluate their security protocols, technology stack and compliance with accounting regulations. Check references and ensure the provider’s pricing aligns with your budget.

3. Negotiate Clear Contract Terms

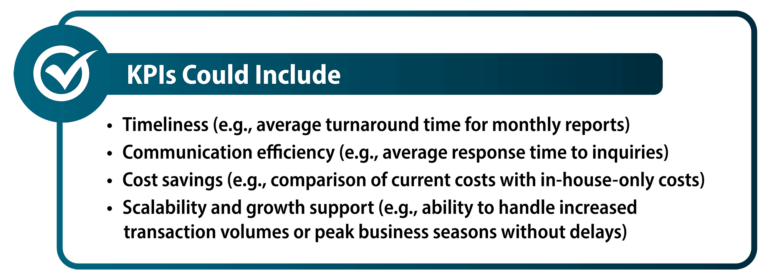

Collaborate with your chosen outsourced bookkeeping provider to establish a clear contract that outlines the scope of services, fees, communication protocols and performance metrics. Be transparent and ensure aligned expectations about deliverables, reporting frequency and timelines. Incorporate provisions for data security and confidentiality to safeguard sensitive financial information.

4. Develop an Integration Plan

A detailed integration plan is essential for success. Work closely with your outsourced bookkeeper to define roles, responsibilities, timelines and key deliverables. Address how the changes will be communicated to staff and stakeholders to manage expectations and minimize resistance. Involve your in-house accounting team throughout onboarding to facilitate a smooth integration.

5. Organize Financial Data

Organize your financial data, ensuring it’s accurate, complete and in a format compatible with your outsourced bookkeeper’s system. Use secure methods, such as encrypted file transfers, to share data (if needed). During this phase, validate that your outsourcing professional adheres to all relevant data security and privacy regulations.

6. Train Your Team on New Processes

Educate your internal team on updated workflows and tools to ensure seamless collaboration with the outsourced bookkeeper. Provide clear instructions on how team members should interact with the provider for day-to-day bookkeeping needs.

7. Establish Communication Channels

Maintain open and transparent communication with your outsourced bookkeeping professional. Set expectations for response times, escalation protocols and regular review meetings. Open and transparent communication ensures alignment and builds trust.

8. Monitor and Evaluate Performance

Once the integration of outsourced bookkeeping services is complete, monitor the outsourcing professional’s performance closely. Use agreed-upon key performance indicators (KPIs) to assess the quality of service, accuracy of reports and adherence to timelines. Schedule regular review meetings to address any issues and make necessary adjustments to improve efficiency and collaboration.

Helping You Get There…

Starting a new partnership with an outsourced bookkeeper can be daunting, but these steps can help ensure success. Conducting a thorough needs assessment, selecting the right outsourced bookkeeping professional, and following a detailed integration plan streamlines the process. Proactive communication and monitoring will help you build a productive partnership with your outsourced bookkeeper, setting your business up for long-term success.

Ready to simplify your bookkeeping? Connect with Boulay’s Accounting Clarity™ team to learn how we can assist with your outsourced accounting needs.