For many small business owners, do-it-yourself (DIY) bookkeeping is the norm. However, as your business grows, managing your books on your own can become overwhelming, costly and time-consuming. Outsourced bookkeeping services can offer significant advantages, including cost and time savings, access to financial expertise, and improved efficiency. However, transitioning from a DIY setup to a fully outsourced bookkeeping model requires strategic planning to ensure minimal disruption. Here, Boulay’s Accounting Clarity Team provides a step-by-step guide to help small businesses successfully transition to outsourced bookkeeping.

Note: sometimes, outsourced bookkeeping services serve better to supplement your in-house function, rather than replace it. This article provides more information about integrating outsourced bookkeeping services with your in-house team.

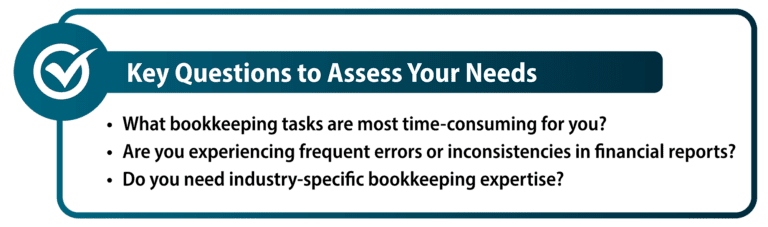

1. Assess Your Bookkeeping Needs

Before outsourcing, take a deep dive into your current bookkeeping operations. Identify pain points and areas that need improvement. Are you struggling with payroll, invoicing, tax preparation or financial reporting? Understanding your specific needs will help you choose the right outsourced bookkeeping provider.

2. Choose the Right Outsourced Bookkeeping Professional

Selecting a reliable outsourced bookkeeping service is crucial to a successful transition. Look for a provider with experience in your industry, strong security measures and scalable solutions that can grow with your business.

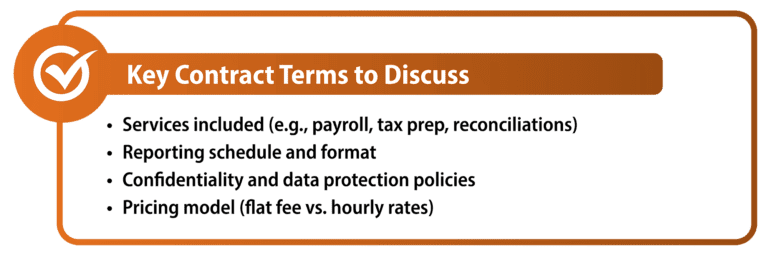

3. Define Scope, Pricing and Expectations

Once you’ve chosen an outsourced bookkeeper, clearly outline the scope of work, pricing structure and communication protocols. Define expectations regarding reporting frequency, deadlines and data security measures.

4. Organize and Streamline Financial Data

A well-structured financial system is key to effective bookkeeping. Boulay’s Accounting Clarity Team works closely with organizations to compile, review, and organize their financial data, ensuring accuracy and efficiency. If your organization isn’t already using QuickBooks Online (QBO), we can facilitate a smooth transition, helping you securely migrate and manage your financial information in the cloud.

5. Implement a Transition Period

A gradual transition helps prevent disruptions. Consider overlapping your DIY processes with the outsourced bookkeeping provider for a set period. This overlap allows for real-time knowledge transfer and troubleshooting before fully outsourcing.

6. Monitor Performance and Optimize Processes

Once the transition to outsourced bookkeeping is complete, regularly evaluate your provider’s performance. Set key performance indicators (KPIs) to measure efficiency, accuracy, and cost savings.

Outsourced Bookkeeping Services for Small Businesses

Transitioning to fully outsourced bookkeeping can streamline operations, reduce costs, and improve financial accuracy for small businesses. By carefully assessing your needs, selecting the right provider, and implementing a structured transition plan, you can ensure a smooth and successful shift.

Ready to outsource your bookkeeping? Connect with Boulay’s Accounting Clarity™ team to learn how we can help simplify your financial operations and support your business growth.