Saving for retirement is an important part of your financial plan, and understanding annual contribution limits can help you take full advantage of available tax benefits. For 2026, higher IRS limits offer new opportunities to build long-term savings through workplace retirement plans like a 401(k).

Below is an overview of 2026 retirement plan contribution limits and what they mean for you.

401(k) contribution limits for 2026

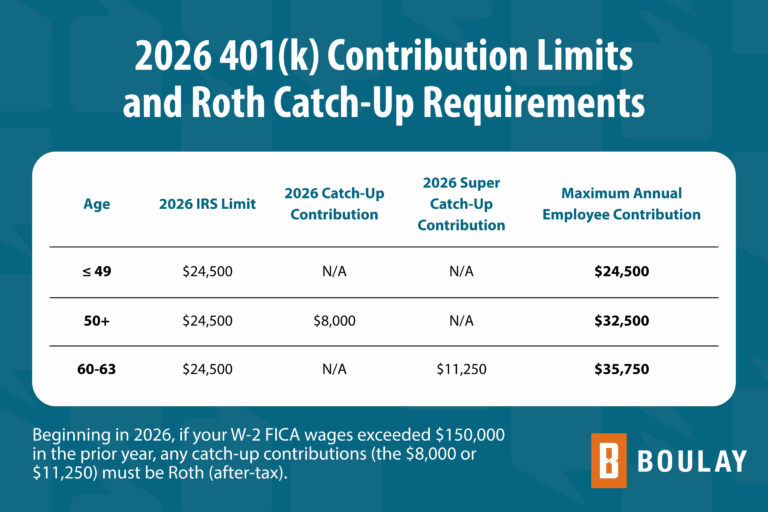

For 2026, the IRS increased the maximum employee salary deferral limit for 401(k), 403(b), and most 457 plans to $24,500. This is the total you can contribute across all employer-sponsored plans, whether contributions are made on a pretax basis, as Roth 401(k) contributions, or a combination of both.

The combined employee and employer contribution limit for 2026 is $72,000, or 100% of eligible compensation, whichever is less. This total includes your contributions, employer matching or profit-sharing contributions, and any allowable after-tax contributions.

Catch-up contributions by age

If you are age 50 or older, you may be eligible to contribute more to your retirement accounts through catch-up contributions.

- Ages 50 and older: An additional $8,000 catch-up contribution, for a total potential employee contribution of $32,500.

- Ages 60-63: Eligible individuals may make a super catch-up contribution of up to $11,250, instead of the standard catch-up limit, if their plan allows. This increases the total employee contribution limit to $35,750.

High-Earner Catch-Up Rule: Beginning in 2026, if your W-2 FICA wages exceeded $150,000 in the prior year, any catch-up contributions (the $8,000 or $11,250) must be Roth (after-tax).

Roth 401(k) and Multiple Plan Rules

The contribution limits for Roth 401(k) plans are the same as traditional 401(k) plans. If you participate in both, your combined employee contributions still cannot exceed $24,500 in 2026, plus any applicable catch-up amounts.

If you change jobs or contribute to multiple 401(k) plans during the year, the annual employee limit applies across all plans combined. Employer contributions, however, are calculated separately by each employer.

After-Tax Contributions and Saving More

Some plans allow after-tax 401(k) contributions, which can help high earners save beyond standard deferral limits. These contributions may be made up to the overall $72,000 plan limit, assuming employee and employer contributions have not already reached that amount. While not available in every plan, after-tax contributions can be powerful when paired with thoughtful tax planning.

What Happens If You Contribute Too Much to Your 401(k)?

Excess contributions may be taxed twice if not corrected. If you exceed the annual limit, you generally must request a corrective distribution by April 15 of the following year to avoid additional tax consequences. This is most common when changing employers midyear.

Planning Ahead for Retirement Success

Understanding contribution limits is just one part of building a strong retirement plan. Boulay Wealth advisors can help you make informed decisions about your 401(k) and other retirement savings so your strategy stays aligned with your long-term goals.

Have questions about your retirement plan? A Boulay Wealth Advisor can help.