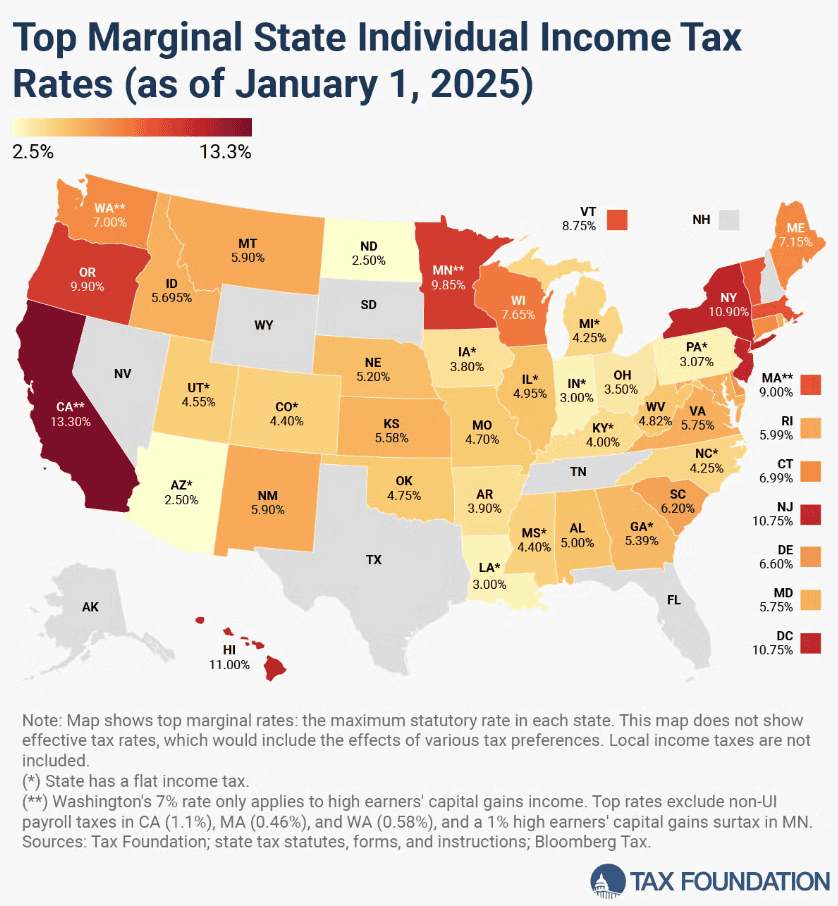

Not all state income tax rates are created equal. While a handful of states impose no income tax, others—including Minnesota—have relatively high tax rates. In fact, the state’s highest marginal rate applies to income levels that affect many taxpayers, especially those earning under $500,000. Furthermore, Minnesota introduced an additional 1% tax on net investment income exceeding $1 million, specifically targeting high earners, starting in the 2024 tax year. These factors may lead Minnesotans to explore whether establishing residency in a tax-free state might be beneficial from a financial planning perspective.

Broadly speaking, if you place a pin anywhere within the continental U.S., you should be within 500 miles of an income-tax free state.

The map below shows how state income tax rates vary across the country. States like Florida, Texas, and Nevada impose no state income tax, making them attractive to high-net-worth individuals and retirees looking to reduce their overall tax burden.

What Does It Take to Become a Resident of Another State?

Clients often ask us about steps to establish residence outside of Minnesota. The answer isn’t as straightforward as just purchasing property in another state or spending time there. The Minnesota Department of Revenue uses a wide range of factors to determine whether someone is still considered a Minnesota resident for tax purposes.

Arguably, the most important factor is how much time you spend in the state you reside in. At a minimum, you should spend at least half of your time there (6 months and a day or 183 days). Other factors include where you vote, file your taxes, and maintain your driver’s license and vehicle registration. They also look at where you work, where you spend your non-working hours, maintain bank accounts, and even where your children go to school or your family attends religious services. None of these factors alone determines residency, but together they create a broader picture of where your true “home” lies.

It’s important to note that this isn’t an all-or-nothing test. The state considers the overall pattern of your life and intent. For example, owning property in Florida doesn’t automatically make you a Florida resident in Minnesota’s view. A clear shift in lifestyle, documentation, and time spent in the new state is required.

For more details, please visit the Minnesota Department of Revenue website.

The Financial Impact of Moving to a Tax-Free State

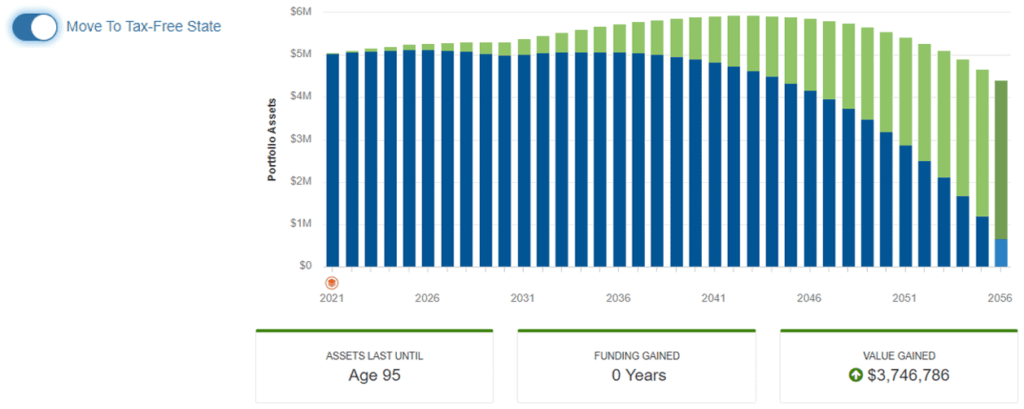

At Boulay, we use a financial planning tool—WealthNAV™—to help clients evaluate the real financial impact of moving to a tax-free state. In some cases, the income tax savings alone can be worth millions over the course of a retirement or long-term financial plan

We analyze not just the tax difference but how those savings interact with your mortgage, real estate goals, investment strategy, and long-term cash flow. Relocating could offer the flexibility to retire earlier, take on less debt, or reallocate resources toward wealth-building opportunities.

In this scenario, a client who moved from Minnesota to Florida saved enough in state income taxes to pay off their existing mortgage and purchase a new home in Florida entirely debt-free. When you factor in years of reduced tax obligations, the financial difference becomes even more significant.

Steps to Take Before Changing Your Residency

Deciding to change your state of residency is a significant financial, and personal, decision. Beyond the lifestyle considerations, you must fully understand the residency compliance requirements in both states to avoid potential legal or tax pitfalls. Even small missteps, such as failing to update voter registration or spending too much time in Minnesota, could trigger an audit or lead to being classified as a Minnesota resident for tax purposes.

If you’re considering a move to a no-income-tax state, we can help you assess the potential tax savings, outline the steps needed to properly change your residency, and build a customized financial strategy to support your decision.

Changing your state of residency can have a significant impact on your financial future. Boulay’s wealth management professionals are here to help you understand the personal and financial implications, follow Minnesota’s residency rules, and take advantage of the tax benefits available in other states.

To explore how a change in residency fits into your financial plan, reach out to a Boulay advisor today.