Planning for retirement doesn’t have to feel like a guessing game – target-date funds (TDFs) can help you stay on track with your savings goals effortlessly. Your employer 401(k) plan likely offers TDFs, designed to adapt your investments as you move closer to your target retirement year. Here, Meghan Hannon, CRPS®, CPFA®, Partner and Head of Retirement Plan Consulting, provides an overview of how TDFs work and where they fit into your life and retirement planning.

How Target-Date Funds Work

When you choose a TDF, you’re selecting a fund geared toward your anticipated retirement year, such as 2030 or 2055. From there, the fund manager does the work for you, adjusting the investment mix over time to reflect your changing risk tolerance. Generally, this means a more growth-oriented approach early on, with a higher allocation to stocks, gradually shifting to more conservative investments like bonds as retirement approaches.

The overall goal of a TDF is to help manage your risk over time: a higher allocation to stocks during your career’s early and middle stages supports long-term growth potential. Later, as you approach retirement, the focus shifts to preserving your accumulated savings and reducing exposure to market fluctuations.

“Through” and “To” Glide Paths

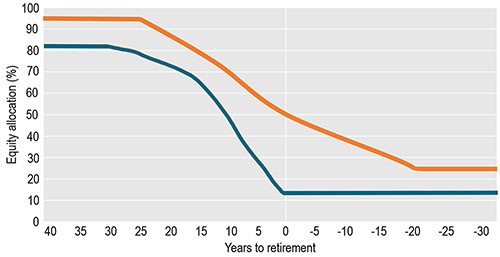

TDFs follow a “glide path” determining how investments will shift over time. However, not all glide paths are the same, and it’s helpful to know the difference between the two main types.

-

-

- Through Glide Path: Funds on this glide path continue adjusting through your target retirement date, generally for 15 to 30 years into retirement. This gradual adjustment can be ideal if you plan to rely more heavily on your 401(k) savings throughout retirement. This avenue typically starts with a higher allocation to stocks (around 85%-95%) during your early working years. Stock exposure gradually reduces through the retirement years, as it reaches the most conservative allocation around 15 to 30 years after the target date. This approach might be appropriate if you:

- Plan to keep your money invested in the plan during retirement

- Want automatic, gradual reductions in market risk during retirement

- Prefer a “hands-off” approach to managing retirement investments

- To Glide Path: Funds on a “to” glide path reach their most conservative investment mix at your target retirement date. This path follows a similar reduction in stock exposure during your working years, with the final, most conservative allocations occurring at the target date. Alternatively to the “through” method, the “to” glide path maintains this conservative allocation without any further adjustments during your retirement years. This approach might work well if you:

- Plan to actively manage your investments in retirement

- Expect to roll over to an IRA or work with a financial advisor

- Want more control over your investment mix

- Through Glide Path: Funds on this glide path continue adjusting through your target retirement date, generally for 15 to 30 years into retirement. This gradual adjustment can be ideal if you plan to rely more heavily on your 401(k) savings throughout retirement. This avenue typically starts with a higher allocation to stocks (around 85%-95%) during your early working years. Stock exposure gradually reduces through the retirement years, as it reaches the most conservative allocation around 15 to 30 years after the target date. This approach might be appropriate if you:

-

Understanding “Through” and “To” TDF Glide Paths

Understanding which glide path strategy your plan’s TDFs follow becomes increasingly important as you approach retirement, as it should influence your overall retirement planning. Neither glide path is necessarily better than the other, but their differences might require adjustments to your investment methods. For example, if your plan offers a “to” glide path strategy but you prefer a more gradual reduction in stock exposure through retirement, you might need to plan for more active management of your investments after retiring, such as working with a wealth management advisor or developing a personal investment strategy. Reach out to your retirement plan advisor to get clarity on the TDF strategy offered within your plan and discuss how it aligns with your unique retirement goals.

Helping You Get There…

Target-Date Funds offer a straightforward way to align your retirement investments with your evolving needs, making them a versatile option for investors at any career stage. Whether you’re just starting to save for retirement or prefer the simplicity of a fund manager adjusting your portfolio over time, TDFs can help you stay on track toward your retirement goals. To learn more about TDFs and explore the best options in your employer 401(k) plan, Boulay’s retirement plan advisors are here to help. Connect with Meghan to learn how we’re dedicated to helping you get there.

Investment Advisory Services offered through Boulay Financial Advisors, LLC a SEC Registered Investment Advisor. Certain Third Party Money Management offered through Valmark Advisers, Inc. a SEC Registered Investment Advisor. Securities offered through Valmark Securities, Inc. Member FINRA, SIPC

Boulay PLLP and Boulay Financial Advisors, LLC are separate entities from Valmark Securities, Inc. and Valmark Advisers, Inc. Prime Global is not affiliated with Valmark Securities, Inc. and Valmark Advisers, Inc.