In today’s fast-changing retirement landscape, businesses seek simpler, more cost-effective ways to offer retirement benefits. Pooled Employer Plans are rising in popularity as a solution that reduces administrative burdens, enhances fiduciary protection, and provides greater access to high-quality retirement plans. But what’s driving this rapid adoption? In this article, Meghan Hannon, CRPS®, CPFA®, Partner and Head of Retirement Plan Consulting, explains the reasons behind the rise in PEP popularity.

Understanding Pooled Employer Plans

A Pooled Employer Plan (PEP) is a type of employer retirement plan created under the SECURE Act of 2019. Unlike traditional multiple employer plans (MEPs), PEPs allow unrelated employers to join a single retirement plan run by a Pooled Plan Provider (PPP). This model allows businesses to outsource much of the fiduciary and administrative responsibility, making retirement plan sponsorship more accessible for businesses of all sizes. According to a recent study by Cerulli Associates, more than 24,000 employers adopted PEPs in 2024, a number expected to continue growing. That rapid rate of adoption pushed total PEP assets past $10 billion in the same year, a figure also projected to increase in 2025.

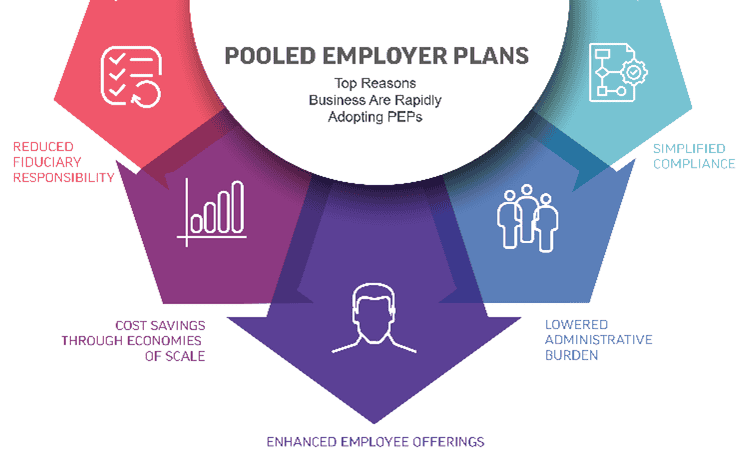

Top Reasons Businesses Are Rapidly Adopting PEPs

- Reduced Fiduciary Responsibility: One of the most attractive features of a PEP is the shifting of most fiduciary duties to the PPP. For many employers, this significantly lowers the risk and complexity associated with offering a retirement plan.

- Lower Administrative Burden: Administering a 401(k) plan requires expertise and ongoing attention. PEPs streamline operations like compliance testing, reporting, and participant communications, freeing HR teams to focus on other priorities.

- Cost Savings Through Economies of Scale: By pooling resources, businesses typically benefit from lower plan costs, such as reduced investment management fees and administrative expenses. Smaller companies, in particular, can access retirement plan features that were once available only to large employers.

- Simplified Compliance: PEPs handle compliance tasks centrally, meaning employers are no longer responsible for facilitating annual audits, Form 5500 filings or plan corrections. This centralized compliance model can reduce overall risk and hassle, simplifying 401(k) management.

- Enhanced Employee Offerings: Offering a competitive retirement plan can help attract and retain top talent. PEPs allow businesses to offer high-quality retirement options without the overwhelming costs and complexities typically involved.

How Regulatory Changes Are Fueling PEP Growth

The passage of the SECURE Act and SECURE 2.0 legislation expanded opportunities for small and mid-sized businesses to offer retirement plans affordably. These laws removed barriers to entry and created strong incentives, such as tax credits for plan startup costs and auto-enrollment features, making PEPs an even more attractive option.

Is a PEP Right for Your Business?

The trend toward PEP adoption shows no signs of slowing. As businesses face increasing pressure to offer attractive benefits while managing costs and risks, joining a Pooled Employer Plan might be the perfect solution. Consulting with a qualified employer retirement plan advisor can help you evaluate if a PEP aligns with your business goals and workforce needs. Connect with us to learn more about Pooled Employer Plans and how we’re committed to helping you get there.

Investment Advisory Services offered through Boulay Financial Advisors, LLC a SEC Registered Investment Advisor. Certain Third Party Money Management offered through Valmark Advisers, Inc. a SEC Registered Investment Advisor. Securities offered through Valmark Securities, Inc. Member FINRA, SIPC

Boulay PLLP and Boulay Financial Advisors, LLC are separate entities from Valmark Securities, Inc. and Valmark Advisers, Inc. Prime Global is not affiliated with Valmark Securities, Inc. and Valmark Advisers, Inc.