The retirement landscape has evolved significantly over the past few decades. From traditional pension plans to 401(k)s and now to more collaborative approaches, employers have continually sought better ways to provide retirement benefits while managing costs and administrative burdens.

Pooled Employer Plans (PEPs) represent the latest evolution in this journey, created through the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019. Before PEPs, there were Multiple Employer Plans (MEPs), but these came with restrictions that limited their adoption.

What Exactly is a Pooled Employer Plan?

A Pooled Employer Plan (PEP) is a type of retirement plan that allows multiple, unrelated employers to participate in a single plan structure. Think of it as a retirement plan co-op where businesses join forces to offer retirement benefits while sharing costs and administrative responsibilities.

The PEP is overseen by a Pooled Plan Provider (PPP), a unique position that takes on much of the fiduciary responsibility and administrative work. This structure allows employers to offer competitive retirement benefits without the full burden of plan management.

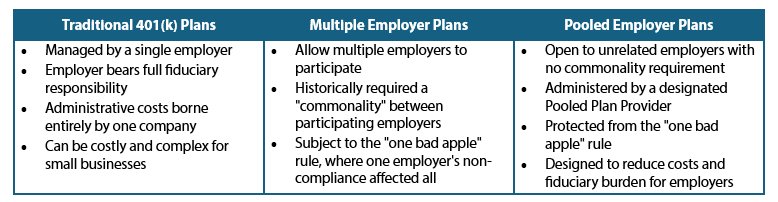

Key Differences Between PEPs, MEPs and Traditional 401(k) Plans

To understand PEPs fully, it helps to compare them with other retirement plan options:

The SECURE Act and How It Changed the Retirement Landscape

The SECURE Act, signed into law in December 2019, was a turning point for employer-sponsored retirement plans. Key reforms included:

- Elimination of the “commonality” requirement that limited MEPs

- Creation of the Pooled Employer Plan Provider role

- Protection of compliant employers from being penalized by others’ noncompliance

- Streamlined reporting and disclosure requirements

These changes made it possible for completely unrelated businesses to join together in a single retirement plan, opening up new possibilities for small and mid-sized businesses that previously found offering retirement benefits too complex or costly.

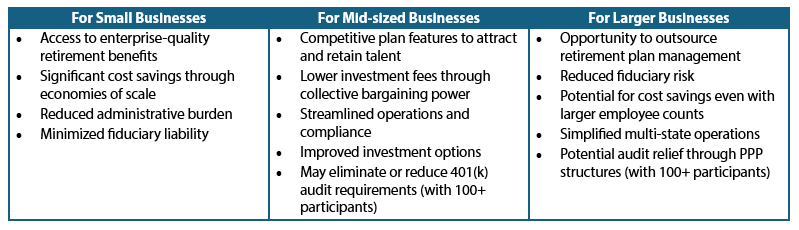

Benefits of Pooled Employer Plans for Different Business Sizes

PEPs offer distinct advantages for businesses of various sizes:

Understanding the Role of the Pooled Plan Provider (PPP)

The Pooled Plan Provider is the cornerstone of the PEP structure. The PPP:

- Serves as the named fiduciary and plan adminstrator

- Handles regulatory compliance and reporting

- Conducts annual audit

- Manages relationships with service providers

- Ensures the plan meets all legal requirements

When selecting a PEP, evaluating the PPP is critical, as they will be responsible for much of your plan’s success and compliance.

Common Questions About Implementing a PEP

Q: Can my business switch from our current 401(k) to a PEP?

A: Yes, businesses can transition from existing 401(k) plan to a PEP, though this requires careful planning and communication with employees. Working with an experienced retirement plan advisor can make this transition seamless while maximizing benefits for both your company and employees.

Q: How much control do we maintain over our retirement plan in a PEP?

A: While joining a PEP involves offloading significant administrative and fiduciary responsibilities to the Pooled Plan Provider (PPP), employers still retain key areas of control, like customizing the plan design, setting employer contribution levels, and shaping the overall employee experience.

Q: Are there any downsides to joining a PEP?

A: Potential downsides include less flexibility in plan design and dependence on the PPP’s performance and longevity.

Q: How do we choose the right PEP for our business?

A: Consider factors like PPP experience, investment options, fee structure, and service provider quality when evaluating different PEPs.

As we continue to see the retirement landscape evolve, Boulay’s RetireNAV(k) PEP represents a smart, scalable option for businesses looking to offer competitive benefits while managing costs and administrative burdens. In our next article, we’ll explore how to select the right Pooled Employer Plan for your business needs. Contact us today to learn how RetireNAV(k) can help you chart a wiser plan.

Investment Advisory Services offered through Boulay Financial Advisors, LLC a SEC Registered Investment Advisor. Certain Third Party Money Management offered through Valmark Advisers, Inc. a SEC Registered Investment Advisor. Securities offered through Valmark Securities, Inc. Member FINRA, SIPC

Boulay PLLP and Boulay Financial Advisors, LLC are separate entities from Valmark Securities, Inc. and Valmark Advisers, Inc. Prime Global is not affiliated with Valmark Securities, Inc. and Valmark Advisers, Inc.