The Mega Roth 401(k) is an extension of a Roth 401(k), but this is a roundabout way to get considerably more assets into eventually a Roth IRA.

Example scenario

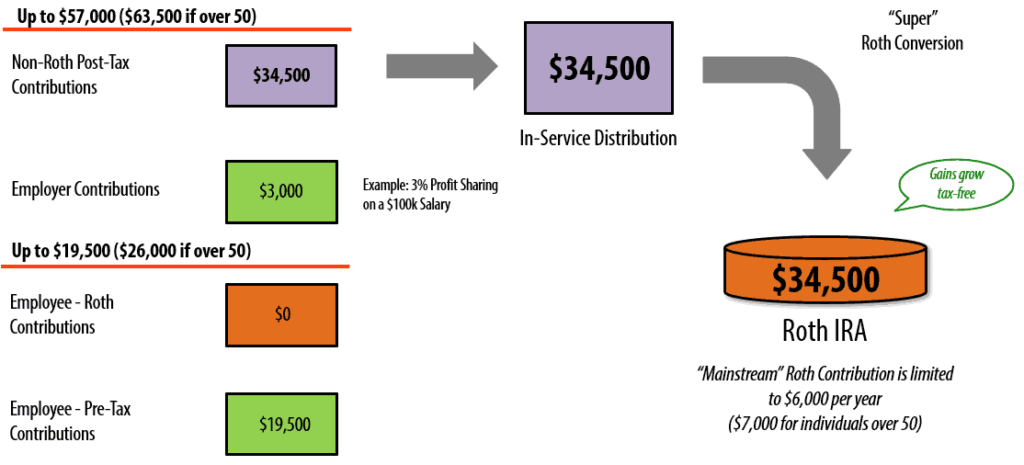

Let us assume you are an employee, you make $100,000 a year, and your company sponsors a 401(k) plan. You are eligible for $19,500 of deductible contributions to the 401(k) plan ($26,000 if you are age 50 or older). The first step in the process is to fill that first bucket and contribute $19,500. For a lot of employees, their company may make a contribution. For this example, that is another 3% on the $100,000 salary, which is another $3,000 in the equation. At this point, you have contributed $19,500 of your own money, and your company has contributed an additional $3,000 on your behalf through a match or a profit-sharing contribution. For a lot of people, that may be of the end of the story; but there is still an opportunity to take advantage of the Mega Roth 401(k) strategy.

Mega Roth 401(k) Strategy

401(k) contribution limits actually have an upper limit called the 415 limit in which anyone under the age of 50 can contribute up to $57,000 to their 401(k) in 2020, and anyone over age of 50 can contribute $63,500. What if you’ve already maxed out your employee contribution and you received your matching or profit sharing contribution from your employer? How do you get to that upper limit?

There is a third type of contribution that can be made to your 401(k) that is called an after-tax or post-tax contribution. This is different than an after-tax Roth contribution or a before-tax traditional 401(k) contribution. These dollars are taxed up front just like a Roth contribution; however, unlike a Roth, if the dollars that are contributed eventually start to grow because they are invested, any growth when distributed would be taxed just the green bucket of money in the example below.

When it comes to this strategy—especially for folks who are young and have a lot of time on their side—the key is to not have that purple money have much time to grow within the plan. But what can we do to prevent the growth from being taxable? That’s where we layer on some special features to a 401(k) in which you can permit participants, i.e. employees, to deliberately transfer while they’re working their contributions to this purple post-tax bucket over to their own individual Roth IRA account, which they own outside of the 401(k) plan.

This allows employees to fill up that capacity for their 401(k) up to that $57,000 threshold. If they make at least $57,000, they can max this out and transfer those purple dollars over to their Roth IRA frequently—whether it be after each payroll, quarterly, or at the end of each year. If those dollars have not grown, the transfer—otherwise known as a conversion to the Roth IRA—is tax free. Once the dollars are in the Roth, they grow tax free for the rest of one’s lifetime.

This strategy allows individuals to contribute five or six times more money to their individual Roth account than they otherwise could contribute directly each year and can be a powerful strategy.

One caveat is that anyone who is not an owner and makes less than $130,000 a year is considered a non-highly compensated employee. Those folks are permitted to make the maximum contributions regardless of what anyone else does. However, for anyone who is an owner of the company or earns more than a $130,000 a year may be considered a highly compensated employee. Even though they can make these contributions, they may be limited to how much they can transfer and convert to their Roth IRA due to fairness testing, which boils down to how much did folks who were non-highly compensated contribute to this purple bucket versus those who are highly compensated. If enough money is contributed by those who are not highly compensated, that allows for the folks at the top who are highly compensated to also contribute significant dollars to the strategy.

Thus, there are some nuances, but this strategy can add a lot of value for your company and employees without costing the company any additional dollars, as these funds all come from the employees’ paychecks.

To learn more about how the strategy could apply to your company or personal situation, reach out to a Boulay wealth management advisor.

*Assuming 2020 limits.