learn. grow. develop.

Being new to the accounting and financial services industry, you want to learn from others, develop your skills and gain experience with a variety of challenges. Boulay provides ample opportunities for career advancement, on-going education, mentoring and lasting friendships. We look for bright and energetic students and graduates to join our team and experience how we work together.

boulay beginnings summer program

During this two-day program, learn about Boulay, our opportunities for students and graduates, and how we help you find a career that’s fit for your life.

MEGAN KOOSMAN

Senior Campus Recruiter

952.847.4857

mkoosman@boulaygroup.com

Find your fit

Discover your interests. No matter the department, gain exposure working with clients in a variety of industries.

Assist with preparation of compilation and review attest engagements, including performing analytical procedures. Additionally, help with financial statement preparation along with forecasting and projection projects.

Assist in audits and reviews of financial statements through all stages of an engagement, including planning and fieldwork, while working in a variety of industries with publicly traded and privately owned clients. Experience working directly with our clients and receive one-on-one training from our team to help you learn and grow in your career.

Gain general and specialized tax exposure and perform tax-related research projects. Prepare various types of trust, gift, estate, and individual tax returns. Assist in managing estate administration and complete special projects as assigned.

Interns and associates will prepare retirement plan related tax forms, analyze census data for eligibility, prepare plan financials, and learn the technical skills needed to be a plan administrator.

Interns and associates are actively involved in client engagements by performing internal control testing as part of SOC 1 / SOC 2 examinations, identifying potential issues and communicating results to department leadership.

Work with clients on tax preparation/planning, and prepare individual, partnership and corporate tax returns. Respond to inquiries from Federal and State taxing authorities, perform tax-related research, and complete special projects as assigned.

Provide direct assistance to experts in various facets of transactional planning and execution. Learn about valuation, financial diligence, transaction structuring, tax planning, and technical accounting.

MEET BOULAY

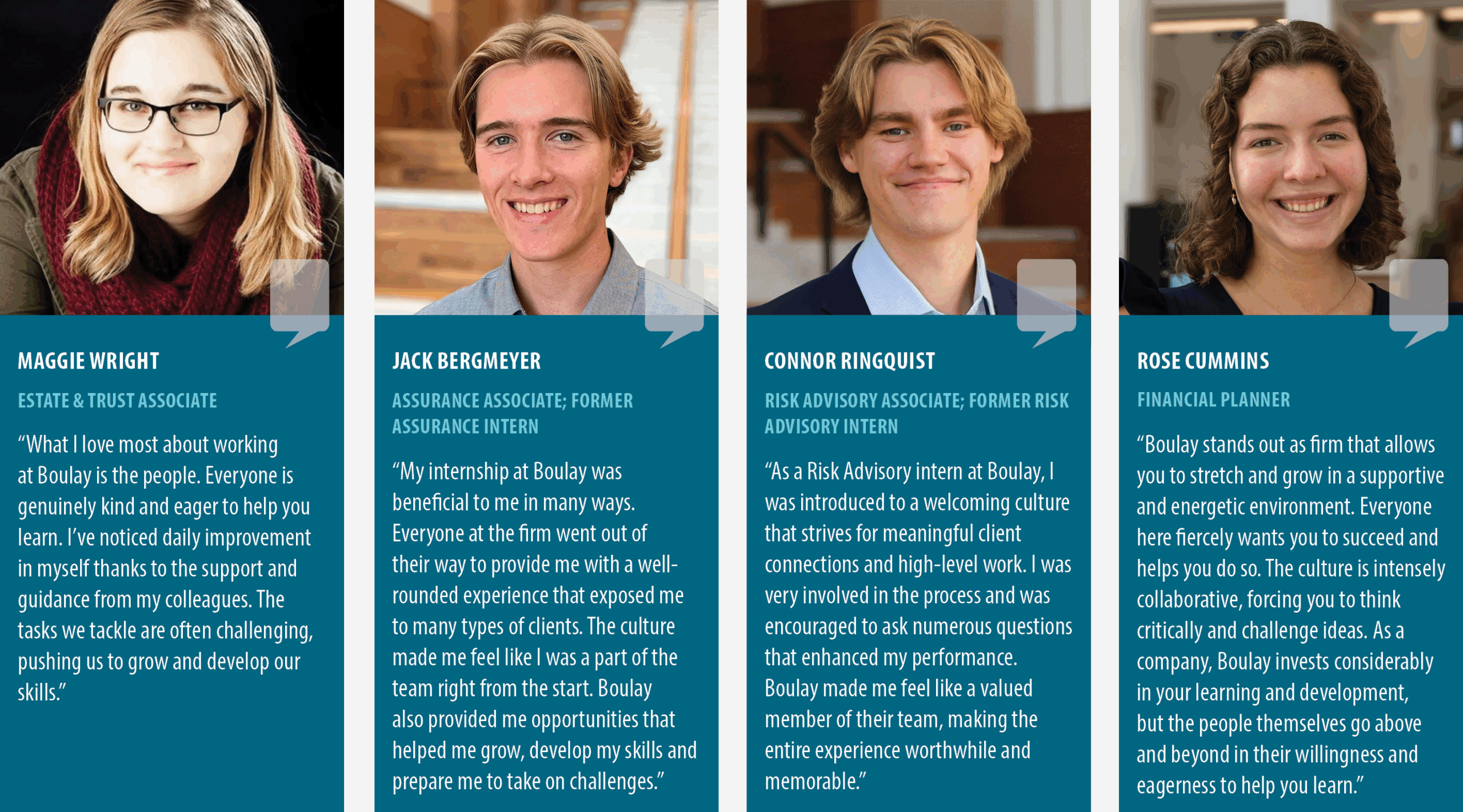

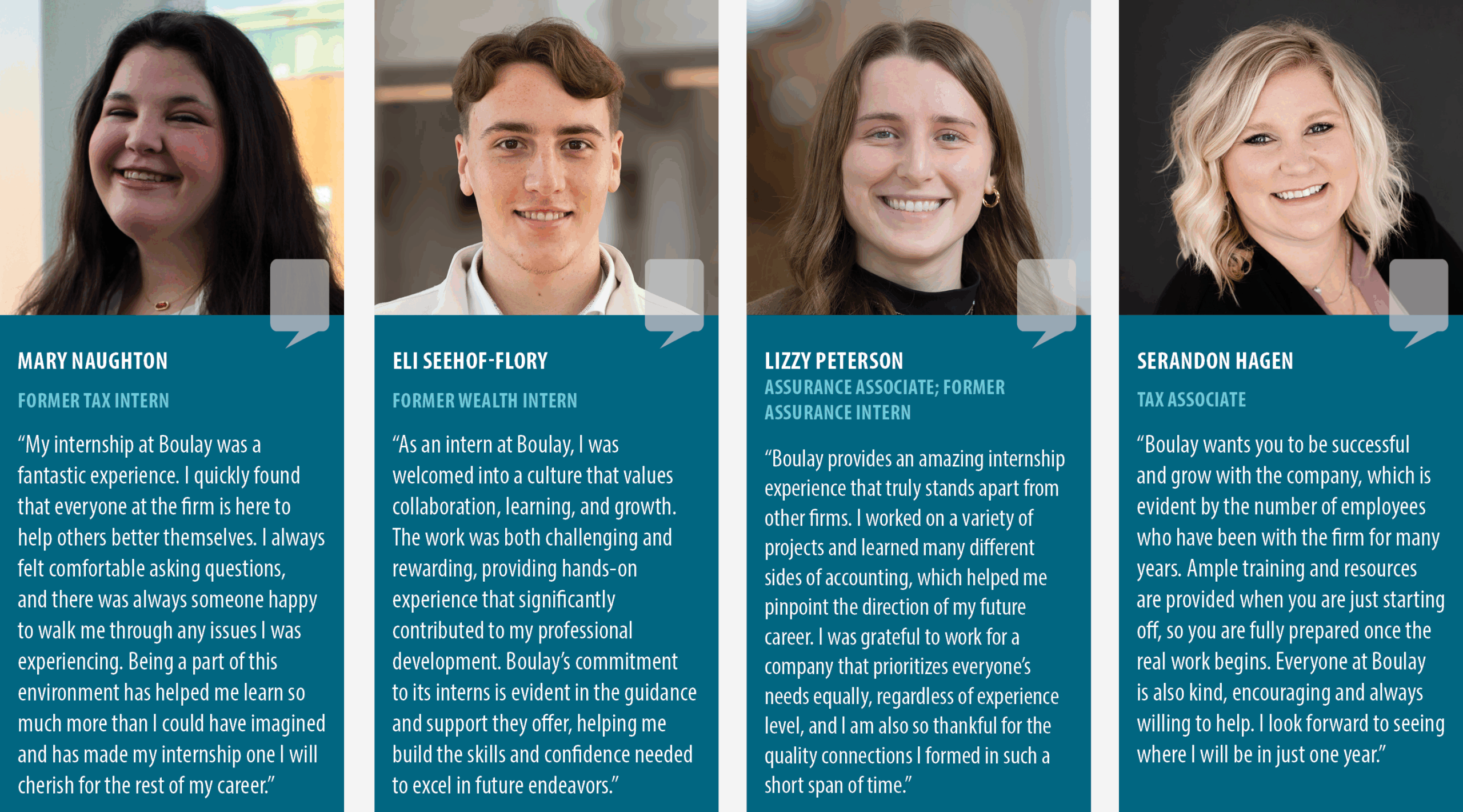

TEAM MEMBER TESTIMONIALS